Hello everyone my name is Alfonso Rodriguez and I'm licensed in real estate and in mortgage. This is going to be a quick & straight to the point post that answers the questions, Should you buy a new or resale home?

Please watch the video below for a quick introduction. You can also call or text me directly @ 512-809-0091.

What a personalized consultation? Fill in your info below.

Property Taxes Make A HUGE Difference

There is so much info surrounding the topic of Texas property taxes that we should spend hours talking about it. The short & simple is that resale homes built 3+ years ago will have a MUCH lower tax bill than a new build & it has to do with how the county give it a value.

Let's take 2 theoretical homes priced at $600,000. One is a new build & the other is a resale home built in 2018.

The new home will be assessed at or near the purchase price of $600,000 by the county after you close on it. Then the tax rate is applied so if the tax rate is 3% then your tax bill for the year will come out to $18,000.

Now let's take that resale home built in 2018 but has a market value of $600,000, the assessed value is likely MUCH lower because back when the home was built property values were much lower. That $600k home may be only assessed at $400k & assuming a 3% tax rate the tax bill would be $12,000.

I'm oversimplifying just so you can get a basic understanding. Most areas are not a 3% tax rate & the examples above does not account for any exemptions you may qualify for.

Continue below for a real work example of how this works...

A Real Life Example

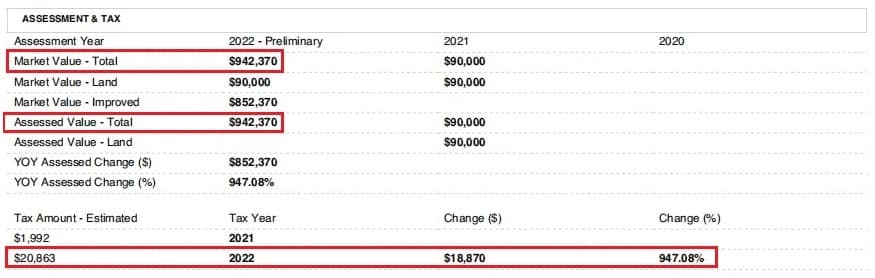

Below is a snap shot of a real world example on a new home built in Georgetown. This home closed in 2022 for a littler over a million & was recently assessed by the county at $942,370. When it was just dirt the assessment was only $90,000. As you can see highlighted, the taxes that will come due for that home will be $18,870 or an extra $1,572.50 on each mortgage payment.

This may not be a big deal for the right person because some folks wouldn't mind the extra cost for the new home with all the latest features.

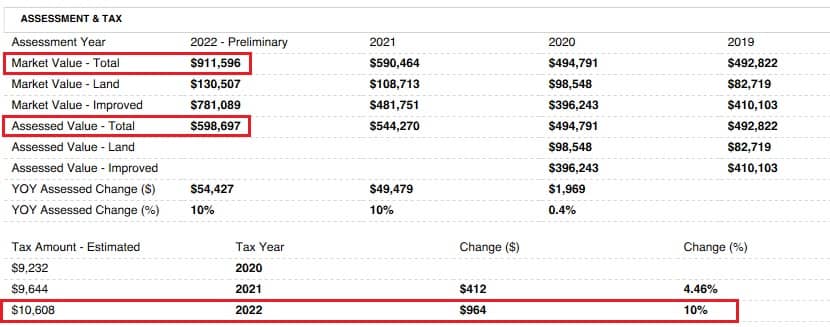

Below is a great example on the value of purchasing a resale home right now. This home, also in Georgetown, was built in 2013 & was sold in May 2022 for $915k.

As you can see below, the county has it's market value at $911,596 BUT the assessed value is set at $598,697 which means that when the county applies the tax rate they'll use the assessed value to determine what you'll pay in property taxes.

Also, since there is a homestead exemption on this home (a great benefit for Texans) the amount the county can raise the value year over year is capped at 10%. This will translate in THOUSANDS of dollars saved each year on your property taxes versus if you bought a new home around the same price.

Still Confused? I'm Here To Help

Buying a home does not have to be a complicated process when you have the right Realtor working for you because a lot of this stuff can get really confusing. There are many details like this that can have a huge impact on your bank account & my job is to be a resource towards helping you make the best decision possible.

Since I'm licensed in both real estate & mortgage I can be your single point of contact for buying & financing your next home. Call or text me directly @ 512-809-0091.

Should You Buy A New or Resale Home?

It all depends on what's most important to you & the best way to answer that questions is by having a free, no obligation consultation with me. This is where I'll learn more about your situation, find out what's most important to you then answer all of your questions & get the info you need so you can decide the next steps.

Thanks for sticking around & reading this post. Please lave a comment below on your thoughts & I look forward to hearing from you.